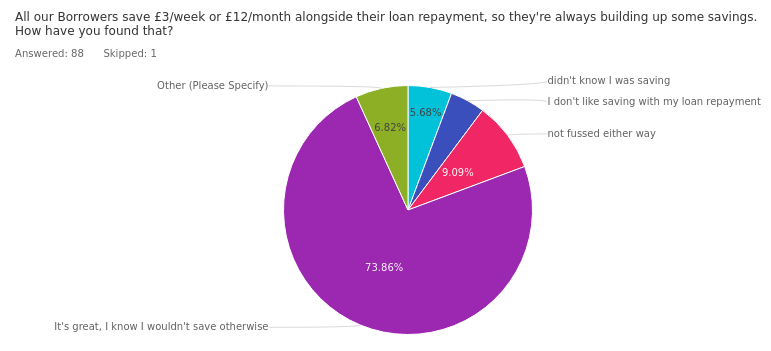

We know that saving is hard. Even with good intentions to save for something important, we often see savers withdrawing their savings. To help make it easy to save, and to learn the saving habit, all our borrowers save a small amount regularly as part of their loan repayment.

Our Save As You Borrow scheme is designed to help you achieve financial security effortlessly.

You make an agreed payment each week or month to cover your agreed loan repayment plus £3/week or £12/month is added to your ‘Holding Saver’ account. You cannot withdraw from the Holding Saver while the loan balance is outstanding. Your savings soon grow to at least £144 over a year.

Some of our Members also choose to increase your savings amount to help grow their savings faster. Maybe save into a Christmas Saver, to help cut the cost of Christmas this year or Goal Saver to set your own savings targets.

We know how difficult it can be to save, especially if you have borrowed for something you need or want. ‘Our Save as you Borrow’ helps you establish a habit of saving and ensures you have funds set aside for future needs. Saving while repaying helps you build habits that last, giving you more peace of mind.

Borrow £500 and repay over a year (52 weeks or 12 months)

| Product | Weekly Payment | Monthly Payment |

| Loan repayment | £11.49 | £50.24 |

| Save-as-you-borrow | £3 | £12 |

| Optional savings e.g. Christmas Saver | £5.51 | £7.76 |

| Total | £20 | £70 |

| Save Each month | After 6 months | After 1 year | After 3 years | After 5 years |

| £12 | £72 | £144 | £432 | £720 |

| £40 | £240 | £480 | £1,440 | £2,400 |

| £100 | £600 | £1,200 | £3,600 | £6,000 |

Jessica borrowed £1,000 for a car repair. By saving £12 per month during her repayment period, she finished her loan with £144 in her savings account

Mark borrowed to finance home improvements. By the end of his loan, he had £300 in savings, which he used for Christmas shopping!